Breaking the Debt Cycle: Strengthening Financial Resilience in Small Island Developing States

Repeated and intensifying climate events push SIDS into cycles of debt, as economic, developmental, and infrastructure damages accumulate. A close examination of disaster-related damages in SIDS reveals that since 1960, there has been a consistent increase in the economic costs of disasters, with a noticeable escalation starting in the mid-1980s. According to the World Meteorological Organization (WMO), the impact on GDP due to weather, climate, and water-related events on SIDS between 1970 and 2020 was $153 billion – a significant amount, considering that the average GDP of SIDS is $13.7 billion.

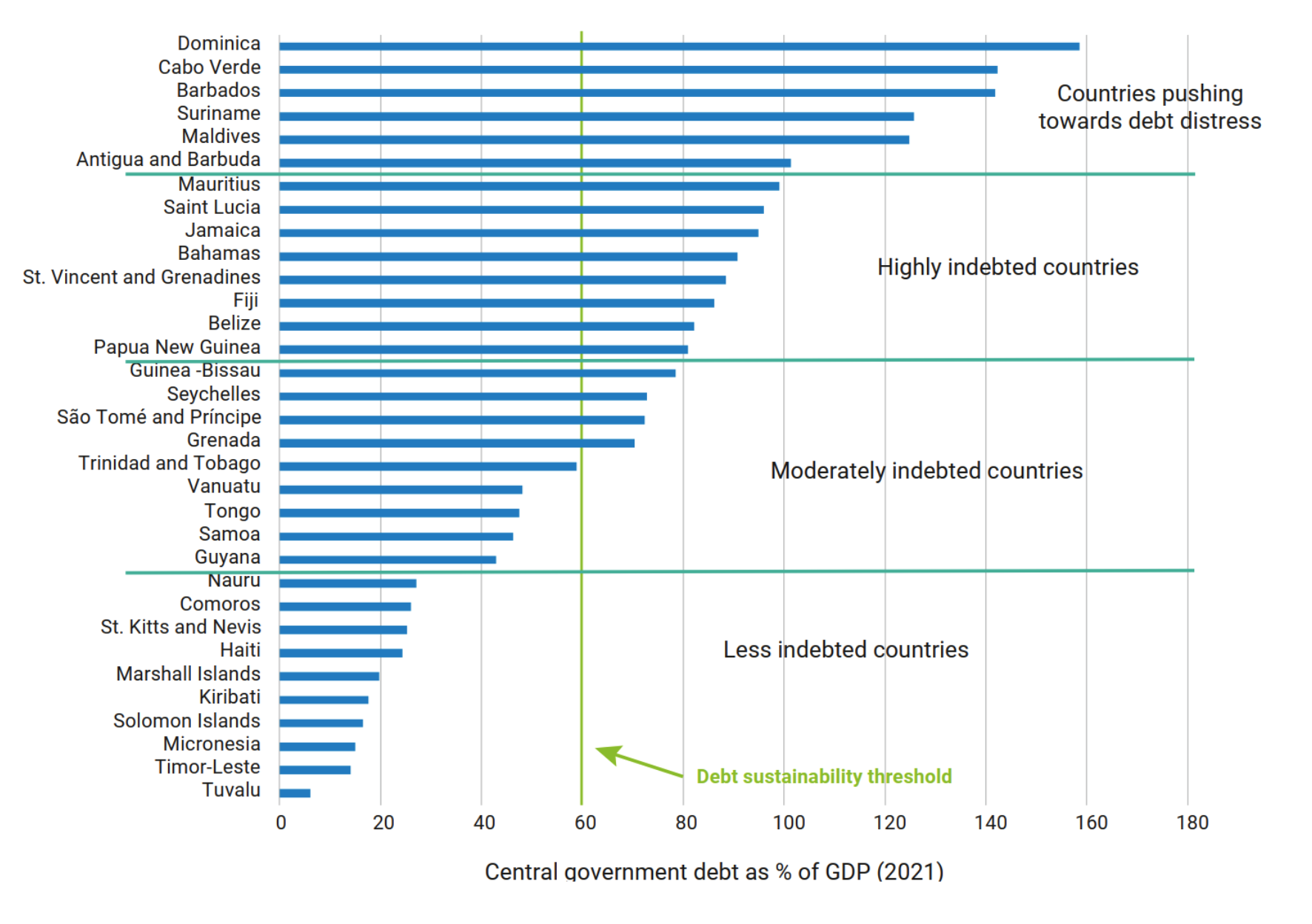

A critical concern for SIDS is the escalating debt-to-GDP ratio, which has reached alarming levels in many of these nations. An analysis of 33 SIDS for which data was available shows that as of 2021, more than 40% of SIDS were either highly indebted or nearing debt distress, with 70% exceeding the critical debt sustainability threshold of 40% of GDP (Figure 1). Every dollar spent on debt repayment reduces the capacity of SIDS to invest in climate resilience and adaptation, further weakening their future resilience and deepening financial challenges.

Figure 1: Classification of SIDS Based on Central Government Debt as a Percentage of GDP

Source: Authors’ calculations based on the World Bank’s International Debt Statistics. https://www.worldbank.org/en/programs/debt-statistics/ids.

Debt accumulation in SIDS is often not due to poor economic policies or financial mismanagement, but rather the significant financial burden of recovering from disasters and the constrained ability to invest in resilience against future climate impacts. In fact, analysis of SIDS debt defaults from 1960 to 2022 shows a clear correlation between high disaster intensity and increased defaults. Notably, debt defaults began to rise in the 1980s and began to surge from 2000 to 2022, with major spikes in 2006 ($657 million), 2010 ($1,261 million), and 2014 ($1,747 million), all years marked by severe natural disasters like hurricanes and cyclones affecting SIDS. This trend leads to deteriorating credit ratings increases the cost of capital for SIDS, as credit rating agencies factor in the risk of default.

For SIDS, breaking this vicious cycle is crucial for survival. Debt relief can only go some way towards addressing the problem. Addressing the intertwined challenges of climate change and debt requires a coordinated international response and a multi-pronged strategy. Beyond some of the existing efforts of the World Bank, G20, and the IMF, some other innovative debt relief solutions are available.

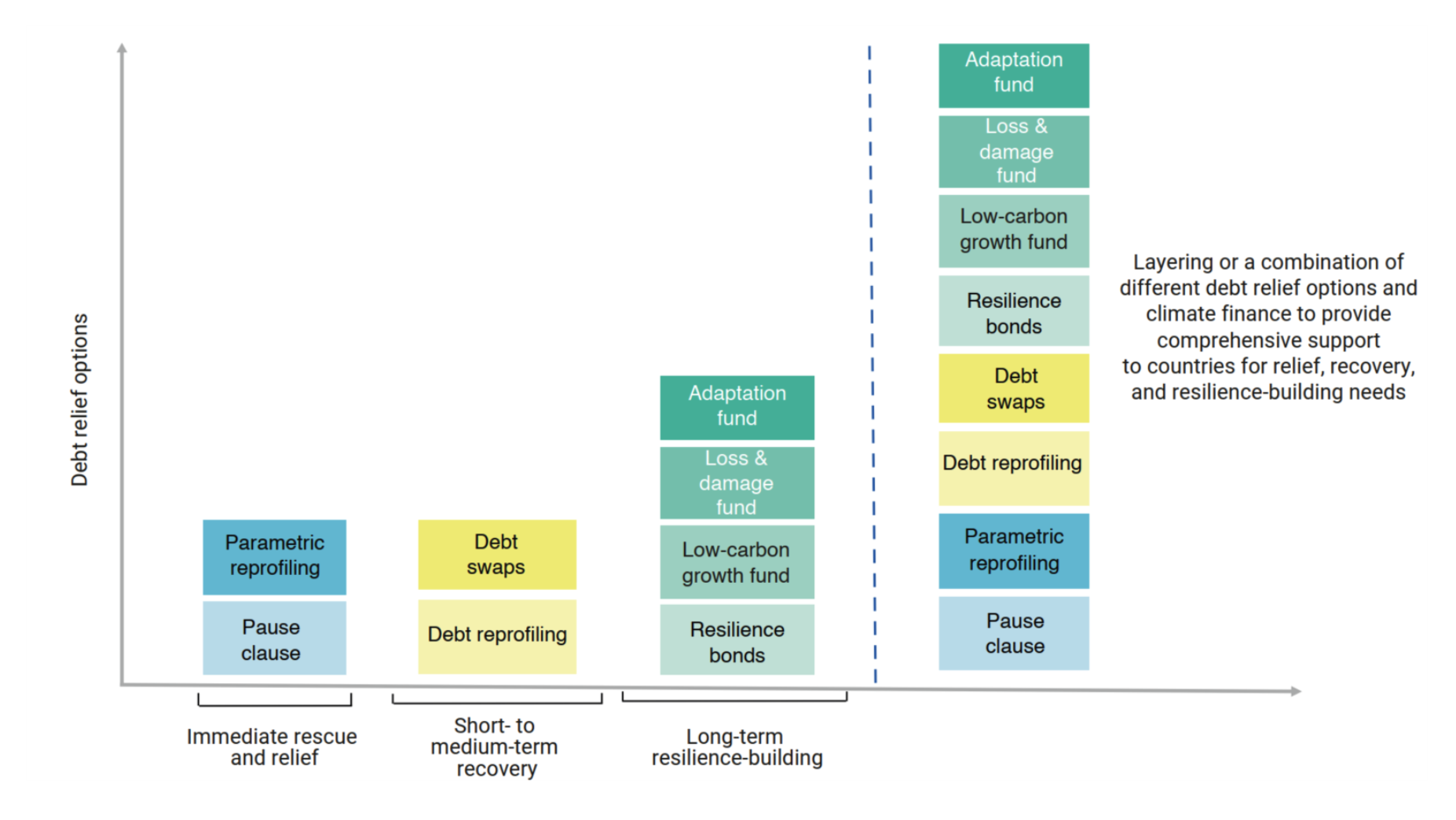

Figure 2: Debt Relief Options in Different Time Frames and with a Multi-Layered Approach

Source: Authors’ illustration

A comprehensive suite of recommendations to reduce the strain of debt on SIDS would include:

Multilayered debt relief

Between 1990–2021, SIDS collectively serviced $394.78 billion in debt. Multilayered debt relief – that includes elements like pause clauses to temporarily suspend debt payments during crises, parametric insurance, debt reprofiling, debt swaps – could reduce annual debt servicing for SIDS from $12.34 billion to $9.49 billion and total debt stock from $153.75 billion to $81.65 billion, potentially boosting GDP growth by 3%.

Future protection mechanisms

Investing in insurance premiums and other financing mechanisms can stabilize growth, reduce poverty, and enable SIDS to invest in social protection, ultimately providing long-term benefits that far outweigh the costs. Analysis based on loss and damage suffered by SIDS in the last 30 years shows that the cost to protect 20%, 50% and 100% loss of GDP would be $21.34 million, $53.35 million, and $106.71 million, respectively. These premiums should be funded through climate finance and other international mechanisms.

Long-term resilience investments

Issuing blue and green bonds to build robust infrastructure would offer SIDS a sustainable alternative to traditional loans. These bonds offer direct financing for initiatives aimed at bolstering resilience to climate-induced impacts. This ranges from funding the establishment of robust infrastructure (storm-resistant housing, sea walls) to backing sustainable endeavours like renewable energy projects, reforestation efforts, or biodiversity conservation. Successfully implementing such bonds would require SIDS to develop a robust strategic plan, put in place financial frameworks and mechanisms for transparency and accountability, invest in capacity-building and market engagement, and carry out rigorous post-issuance fund management.

Advisor support and legal aid

In the complex world of global finance, SIDS often face significant challenges due to limited expertise in debt restructuring, credit negotiations, and navigating financial ecosystems. A legal and advisory support platform could greatly enhance the ability of SIDS in navigating the intersection of debt and climate impacts, crafting the terms for resilience bonds and insurance products, enhance their collective voice in international negotiations, and facilitating knowledge transfer and upskilling of government negotiators, legal teams, and NGOs in debt management and investment negotiations

For this holistic solution to succeed, international cooperation and commitment are crucial. Institutions like the World Bank, IMF, and Asian Development Bank, along with developed countries and philanthropic organizations, must support SIDS through climate finance, concessional finance, and grants rooted in climate justice and solidarity. The challenges faced by SIDS demand a united approach and shared responsibility, ensuring these states have the means to protect themselves from existential threats.

Chandrahas Choudhury is a writer and editor based in India. This blog is based on the Debt chapter from the STA2025 report, authored by Ritu Bharadwaj (International Institute for Environment and Development [IIED]) and N. Karthikeyan (independent development economist)

The ideas presented in this article aim to inspire adaptation action – they are the views of the author and do not necessarily reflect those of the Global Center on Adaptation.