Three Ways to Bridge the Adaptation Funding Gap in Africa

The impacts of climate change are being felt around the world, but nowhere more acutely than in Africa. Rising temperatures, unpredictable weather patterns and natural disasters are affecting the continent’s ability to develop and thrive.

D

espite this, our analysis shows that the current levels of total adaptation finance flows into Africa are insufficient to meet the continent’s growing needs. In addition, the amounts of private capital that have been mobilized have been disappointingly low, raising serious questions regarding prevailing blended finance approaches. According to an analysis of the Nationally Determined Contributions (NDCs) of 51 African countries, an estimated US$579.2 billion in adaptation finance is needed for Africa over the period 2020–2030.

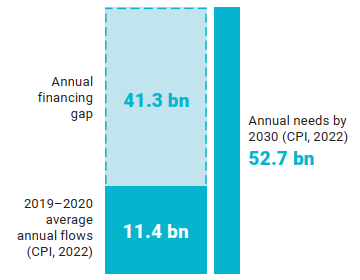

If this trend were to continue through 2030, adaptation finance would total US$125.4 billion, falling far short of US$579.2 billion – approximately US$52.7 billion annually – in estimated finance needs. The mobilization of private capital is now also hampered by growing debt problems in many emerging markets and developing economies. According to the International Monetary Fund, about 15% of low- incomes countries are already in debt distress and another 45% face high debt vulnerabilities.

Adaptation Finance Commitments (US$bn) vs. Needs in Africa

(Source: State and Trends in Adaptation Report 2022)

Nevertheless, urgent action is required to bridge the adaptation funding gap. In the Global Center on Adaptation’s flagship report State and Trends in Adaptation, we highlight three ways to achieve this:

1. Build an Enabling Environment

The enabling environment of a country is critical to the viability of adaptation investment. To build their enabling environments for adaptation investment, there are three key areas in which African countries can focus their efforts:

- Regulatory and Legal Instruments

A country’s legal and regulatory framework can create an enabling environment to mobilize adaptation finance and climate-proof public and private sector investments. Dedicated climate laws, national strategies, and directives from financial authorities help set the scene for adaptation finance and define the overall level of ambition by showcasing high-level endorsement. Sector-specific regulations and action plans can also help translate national-level goals into concrete actions. African countries should articulate investment-ready National Adaptation Plans and mainstream climate resilience in government procurement.

- Capacity building for science-based policy and projects

Attribution between a climate impact and the corresponding action that aims to mitigate that impact must be established. This attribution is challenging, requires substantial quantitative and science capacity, and is often a critical factor for mobilizing adaptation finance. There is a substantial need to increase capacity to translate science into policy and policy into investment needs – for instance, by using climate resilience indicators to prioritize budget allocations.

- Improve macroeconomic environments through a multifaceted approach

The participation of private creditors is critical to relieve existing debt burdens in Africa, and requires innovative financing models that set clear incentives. Additional actions to consider for addressing debt challenges in African countries include:

- Advancing efforts to link credit ratings with reductions in climate risk to incentivize resilience and lower the cost of debt

- Continuing the implementation of the Debt Service Suspension Initiative program and seeking as many avenues as possible for alleviating debt strain on African countries as a key strategy for increasing domestic adaptation finance

- Exploring the development of sovereign bonds with an adaptation component

2. Mainstream Adaptation and Resilience into Investment Decision-making

Many investors in Africa are already engaged in investments that are significantly relevant to adaptation goals, but their investments are not yet climate-resilient. To enable financial institutions to mainstream resilience into the investments they are making, it is critical to:

- Increase access to robust climate information

There is a considerable lack of climate data in many parts of Africa. Increasing access to high-resolution climate data at low cost so that implementers may undertake climate risk assessments as a basis for future adaptation planning is a top priority.

- Build the capacity of African financial institutions and government entities to evaluate and act on climate risks

A concerted effort should be made to increase the membership of pan-African banks, locally based pension funds, and national development banks in international financial initiatives, and to provide these institutions with the resources to participate actively. Capacity building is also crucial to strengthen African financial institutions’ capacity to access finance from Climate Funds through pre- and post-accreditation support. Read more about GCA’s Technical Assistance Program on this issue here

- Require disclosure of climate risks

A better understanding of climate risks and vulnerabilities for individuals, firms, and the public sector is paramount in defining adaptation needs and thus, for mobilizing and accessing adaptation finance. Climate-related financial risk disclosures regarding adaptation and disaster risk can do just this. The Task Force on Climate-Related Financial Disclosures provides specific guidelines on how to disclose such risks. A better understanding of climate-related risks, in combination with a clear taxonomy defining what counts as a climate adaptation project, can motivate the private sector to enhance its climate resilience through adaptation investments.

3. Deploy Innovative Financial Instruments

Financial instruments can be used to finance activities that build physical resilience to climate change impacts and reduce physical risk. Financial instruments are also useful in responding to risks where physical climate impacts cannot or have not been eliminated, in particular through risk-transfer and risk-reduction instruments.

Debt for climate or nature swaps is one example of an innovative finance instrument that can be deployed to help reduce risk. A debt swap converts national debt servicing payments on external debt into domestic investments, which can in turn be directed toward projects or programs that support national sustainable development or climate goals.

Action taken now across the full range of potential adaptation finance sources is critical to determine the course of Africa’s capacity to respond to present and oncoming climate impacts and to build a more climate-resilient and liveable future.

Prof. Jamal Saghir is a Professor of Practice at the Institute for the Study of International Development at McGill University. He has over 25 years of experience at the World Bank Group directing departments related to energy and infrastructure, water, transport, agriculture and rural development, environment and climate change. A Senior Fellow at the Payne Institute at the Colorado School of Mines, and Distinguished Fellow for Economics and Development at the American University of Beirut, Prof. Saghir also serves as a Member of the Board of Directors for Cica SA; Satram-Huiles SA and FFA Private Bank. He is also Chair of the Advisory Committee of the Climate/SDGs Debt Swap Mechanism at UN-ESCWA; a member of the Advisory Board of the Middle East Water Forum; and a member of the Council, UN Sustainable Development Goal on Poverty Eradication, World Government Summit.