Mobilizing Finance for Adaptation at COP27: Next Steps in Aligning Finance and Investment with Climate-Resilient Development Goals

At COP26, the Glasgow Financial Alliance for Net Zero (GFANZ) achieved a major milestone by bringing together financial institutions to make a collective commitment to align over $130 trillion in assets with the goal of achieving net zero by 2050. Now, the world needs a similar effort for adaptation and resilience.

B

y 2025, global assets under management are expected to reach $145 trillion. Why is this crucial for adaptation, particularly for those countries most in need in the Global South?

Because finance is global and this capital can either be deployed in ways that build resilience or undermine it.

The Glasgow Climate Pact included the call to double climate finance for adaptation, reaching flows of $40billion per year by 2025. This is essential, but we argue that it is not enough.

A new paper we authored on climate-resilient finance and investment argues that scaling from billions to trillions needed for adaptation globally will also require aligning the trillions of dollars of global public and private financial flows and investment with climate-resilient development.

Take the case of infrastructure. Total investment globally is projected to reach $3 trillion per year by 2025 – more than 60 times larger than all tracked, earmarked climate finance for adaptation.

Such investments can lock in climate-related risks for decades, yet, in many parts of the world, buildings and infrastructure still do not meet minimum design standards. Recent research by the World Bank found that since 1985, nearly 80,000 km2 of newly urbanized land were added in locations at high risk of flooding.

What if this could be turned around and global finance re-targeted towards activities that enhance our ability to adapt to climate change? Building resilient cities and infrastructure, catalyzing sustainable agriculture, investing in more water-efficient industries, and supporting nature recovery are some examples of how we could do this.

This goal is included within article 2.1c of the Paris Agreement, which calls for finance flows to be aligned with both adaptation and mitigation. However, this is yet to be put into practice.

Moving from physical risk management to alignment

Physical climate risks need to be consistently assessed and priced within the financial system and the real economy. Companies face risks to their assets and bottom line from climate change and this in turn creates risk for people and economies.

Progress is being made, with new disclosure and supervisory requirements adopted across the world’s financial centers, spearheaded by the Task Force for Climate-Related Financial Disclosures, and backed by new coalitions and approaches from organizations like the Coalition for Climate Resilient Investment (CCRI).

However, physical risk management and alignment are not the same thing. Managing risks to your own assets and operations is only part of the equation. The way in which those risks are managed also matters. For example, agricultural producers could safeguard their production by exploiting scarce groundwater resources or increasing the efficiency of irrigation. In our paper, we argue that given the scale of climate impacts, companies also need to ensure that their adaptation responses do not undermine the resilience of others.

A proposed framework for analyzing firms’ contribution to climate impacts analogous to ‘scope 1, 2, 3 emissions.’ Source: Ranger and Mullan 2022 (forthcoming)

To use the language of mitigation, companies should consider their direct and indirect impacts on climate resilience – for example, adapting their own property to changing climate conditions (Scope 1) as well as adapting their use of resources like water to ensure efficiency (Scope 2). Scope 3 – the resilience impacts of whole upstream and downstream value-chain – is vital yet often forgotten. Take the case of a large food producer – how and where supplies are sourced can have a great impact on community and global resilience.

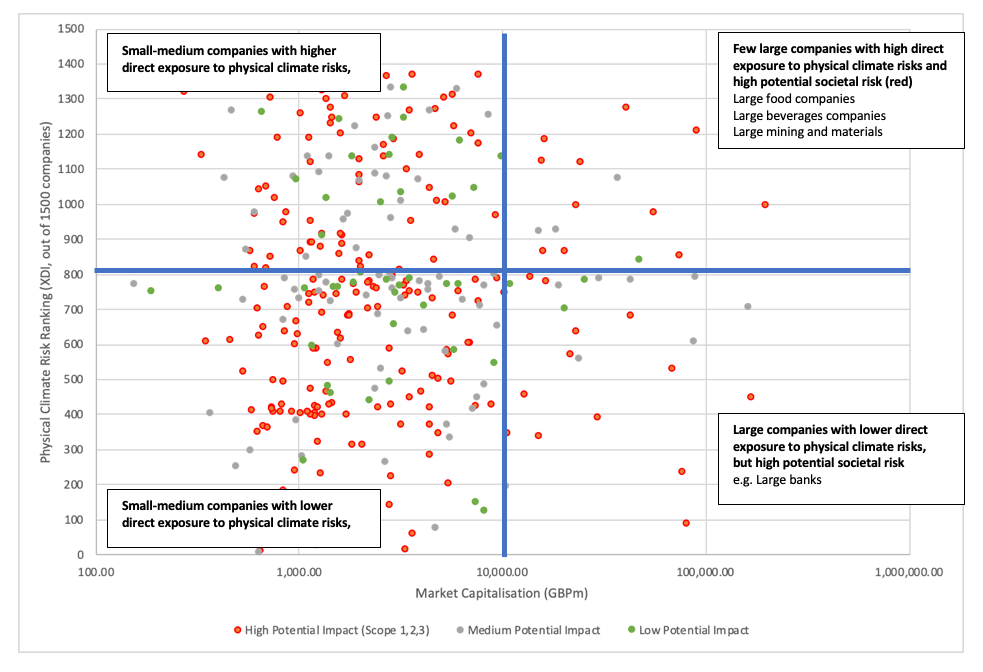

The opportunity is significant. Let’s take FTSE 350 index companies. Almost 45% of those companies (or $1.7 trillion in market capitalization), are in sectors that are likely to have a direct and meaningful impact on wider societal resilience globally, such as food and beverages, construction, real-estate, chemicals, and insurance. Including Scope 3 (‘financed resilience impacts’) over 60% of FTSE 350 companies ($1.8 trillion in market capitalization) could potentially be having a major footprint on global resilience. A handful of companies stand out as large, high potential physical risk and high impact.

If companies start building adaptation alignment, not just risk management, into their own adaptation plans, then we can turn the impacts of companies on societal resilience to a net positive and boost adaptation globally.

Physical climate risk rating (source: XDI), market capitalization (source: LSEG) and sector-based societal impact (low, medium, high) for FTSE 350 companies. Source: Ranger and Mullan 2022 (forthcoming)

How can we address this?

There is a growing volume of analysis on alignment with mitigation objectives, including by the OECD Research Collaborative. Adaptation remains at an earlier stage, although activity is accelerating in the run-up to COP27. Currently, there is no framework to identify or track how finance and investment flows portfolios positively or negatively impact resilience outcomes. This must be the first step.

Measurement can support better management. Disclosing the impact of investments on climate resilience, as well as physical risks to the entity itself, is a first step towards incentivizing investors to act and helps mobilize asset owners and shareholders to hold companies to account. The Institutional Investors Group on Climate Change (IIGCC) recently put out an important first a consultation draft on how to do this and the UN Environment Programme Finance Initiative (UNEP FI) is also active in this area.

We need a common set of metrics for measuring resilience – equivalent to emissions and ‘net zero’ – to consistently assess the impacts of investments on resilience and allow companies to put in place ‘adaptation transition plans’. Public good data initiatives such as the Global Resilience Index Initiative are spearheading this. Frameworks for more consistent disclosure of adaptation plans can also play an important role and would complement ongoing work by the UK’s Transition Plan Taskforce, OECD, GFANZ and others on guidance for corporate net-zero transition plans.

Information is critical to empower investors to be effective stewards of capital.

Lastly, the public sector has a critical role in creating a strong enabling environment – pulling the right policy and regulation levers, setting clear goals and national investment plans and providing the right data, public procurement policies, finance, regulation and supervisory practices to steer private capital in a resilience-positive direction. In this regard, the work of the Adaptation & Resilience Investors Collaborative, formed by the Global Center on Adaptation with public development banks from around the world, is showing promising results in its goal to accelerate and scale-up private investment in adaptation.

All finance flows need to pull together – both on mitigation and adaptation – and COP27, in less than a month, is a critical moment to achieve this.

The ideas presented in this article aim to inspire adaptation action – they are the views of the authors and do not necessarily reflect those of the Global Center on Adaptation.